Tax Optimisation Tool-Hindu Undivided Family

People are still looking for tax-saving strategies. But do you know there is a powerful tax-saving technique right in your own home? Yes, and it’s a Hindu Undivided/Unified Family (HUF).

HUF is utilized as an effective tax-saving structure to lower taxes using correct tax planning. The concept of HUF (Hindu undivided family) is very important in India. Since joint families exist in Indian culture, a family’s income is taxed as joint income.

To make a Hindu undivided family a legal tax-saving tool, the name of a HUF must be properly registered. It should be backed up with a legal document or HUF deed. The deed must include information on the HUF members as well as the HUF’s business or source of income. A PAN number and a bank account should be registered in the name of the HUF.

What is the Background or History of Undivided Hindu Family?

People must be considering the background/history of an undivided Hindu family; continue reading to learn everything there is to know about HUF.

The HUF gained legal recognition in the late nineteenth century, but it wasn’t until the Income Tax Act under colonial authority in 1922 that it was recognized as a separate and independent tax organization. Since then, the HUF legal category has been in the tax legislation.

What does HUF stand for?

HUF (Hindu Undivided Family)

A HUF is a family under Hindu law that comprises all individuals lineally descended from a common ancestor, as well as their spouses and unmarried daughters. A HUF cannot be formed by a contract; rather, it is formed naturally inside a Hindu family.

How is it formed?

At the time of marriage, a HUF is immediately formed. It cannot be founded by a single individual; it can only be formed by a family. The HUF is made up of all of his direct descendants, including spouses and unmarried daughters, who share a common ancestor. HUFs can be formed by Hindus, Buddhists, Jains, and Sikhs.

What are the most important positions or roles in HUF?

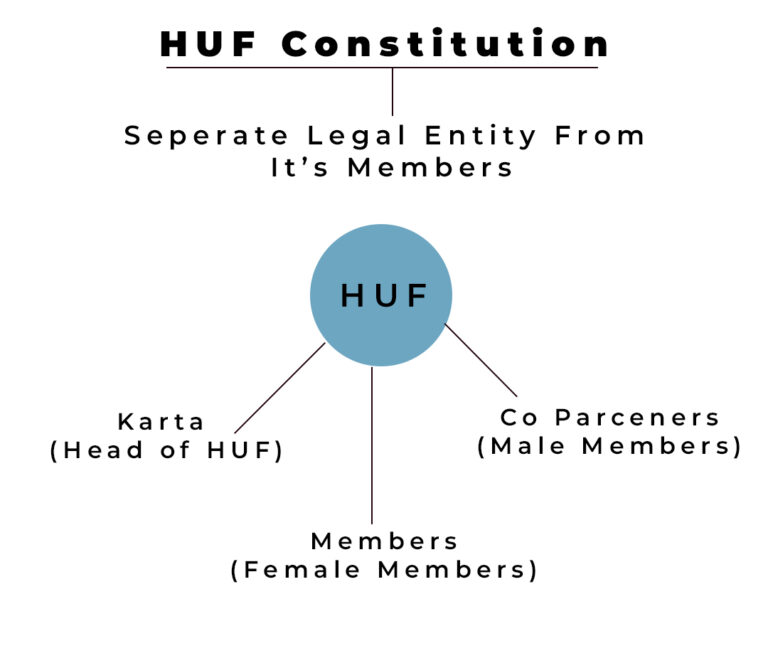

A Hindu Undivided Family (HUF) is made up of Karta , coparceners and members under Indian succession rules.

Karta- The eldest member of the HUF is the Karta, who serves as the family’s leader and is in charge of the HUF’s legal and financial matters.

Coparcener- Any male child born in the HUF becomes coparcener birth. For instance, during the marriage of Ramesh and Sangeeta HUF is formed. Their sons will be the coparceners in the HUF. We can say Male members of HUF are called coparceners

Members-Any female child born in the HUF becomes a coparcener at birth. For instance, during the marriage of Ramesh and Sangeeta HUF is formed. Their daughters will be members of the HUF. We can say females are members of HUF but not coparceners.

Difference between Coparcener and Member

All Coparceners of HUF will be members of HUF but all members would not be Coparcener.

The Coparcener ( male members) of HUF can demand partition of HUF whereas female members can’t demand partition of HUF.

What are the different sources of income that HUF might have?

Except for salary, the HUF entity is permitted to make money by any legal method. It can conduct business, invest in real estate and market-linked investment alternatives such as shares, and make revenue through rent, among other things. The HUF must submit ITRs online (Income Tax Returns) and the income produced will be taxed according to the given slabs.

Is it possible for HUF to make payments to Karta, CoParceners, and members?

Distribute income to coparceners: The Karta can distribute income obtained by the HUF to coparceners. In the hands of the coparceners, this income will be Taxable.

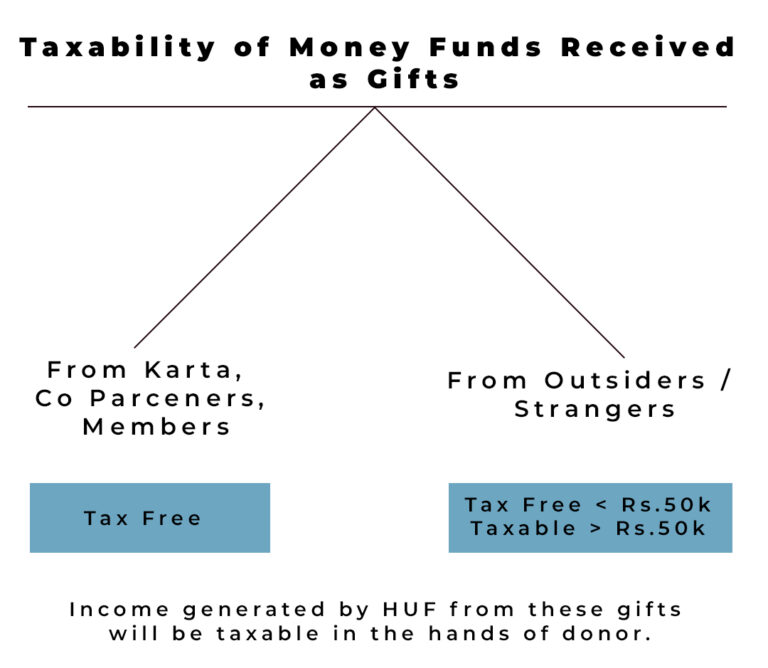

Can HUF receive money or funds as gifts from Karta, CoParceners, and Members?

Yes, HUF can receive money, funds, or property from Karta, Co Parceners, or members. Any sum received by HUF from them will be tax-free for HUF. Here important point to note is that income derived by HUF from investing these funds will be taxable in the hands of the Donor as per the provisions of Section 64(2) of the Income Tax Act 1961.

Can HUF receive gifts from outsiders?

Yes HUF can receive gifts from outsiders or nonrelatives. Such gifts will be exempt in the hands of HUF to the extent of Rs 50,000 only.

How can one put money into the HUF?

- Fill out an application for a PAN Card for the HUF.

- Open a bank account in the HUF’s name (the bank will provide the format for the Karta of the HUF to open the savings account).

- Transfer assets or property to the HUF while keeping in mind clubbing requirements and the tax on gifts to the HUF.

What is the taxability of money/funds received in HUF from Karta CoParceners Members?

A quantity of money acquired without consideration by a person or HUF is taxable if the total amount received throughout the year exceeds Rs. 50,000. The exception to this rule is that any gifts received from Relatives are tax exempt. For HUF the relatives mean Karta, Co Parceners, and Members. So any amount received by HUF from them will be tax-free for it.

How does forming a HUF optimize income tax?

The HUF income tax bracket is the same as that of a person, with an exemption ceiling of Rs 2.5 lakh, and it is eligible for all tax incentives under Sections 80C, 80D, 80G, and so on. It also benefits from capital gains exemptions under Sections 54 and 54F.

As soon as the new HUF PAN card is issued, the family may begin paying their taxes on their own. The HUF may then begin filing ITRs with the new PAN card. If the yearly family income exceeds the limit, the family will be taxed at 10%, 20%, and 30% of the income in the slab, respectively.

The Tax Planet’s View

The process of forming a HUF is easy and is filled with tax benefits, but as we all know, it’s not always sunshine and rainbows everywhere. HUF is tricky and requires the permission of all the members. Besides, people should know about the disadvantages as well. It is a fact that all assets in the name of HUF (Hindu Undivided Family) are only assets of the family and not of a specific individual. So we should take everything into consideration, the benefits and the drawbacks.

Popular Articles

CONTACT US

ADDRESS

10 ,Basement, Vinoba Puri, Lajpat Nagar II, New Delhi, Delhi 110024

Call

Email ID

.png)